The Joint Center for Housing Studies of Harvard University tracks leading indicators in the remodeling industry. In just the past two years, national spending on improvements and repairs have increased 19 percent and are projected to increase another 6 percent over the next year. Drive down any street in Manhattan Beach and you can see this trend of personalization playing out in a significant way.

This year the Manhattan Beach Community Development Department will issue about 170 new housing permits and an additional 980 remodel permits. They handle about 80 visits to their counter daily. Some of these visits are from architects and developers who team up to build spec homes,, a trend we have seen here for several years but that has been recently slowing down.

The number of full build-outs peaked in 2007, when 27 percent of all homes sold in Manhattan were developed within the previous two years, compared to just 18 percent of homes sold in 2000. Last year the number dropped off to 12 percent.

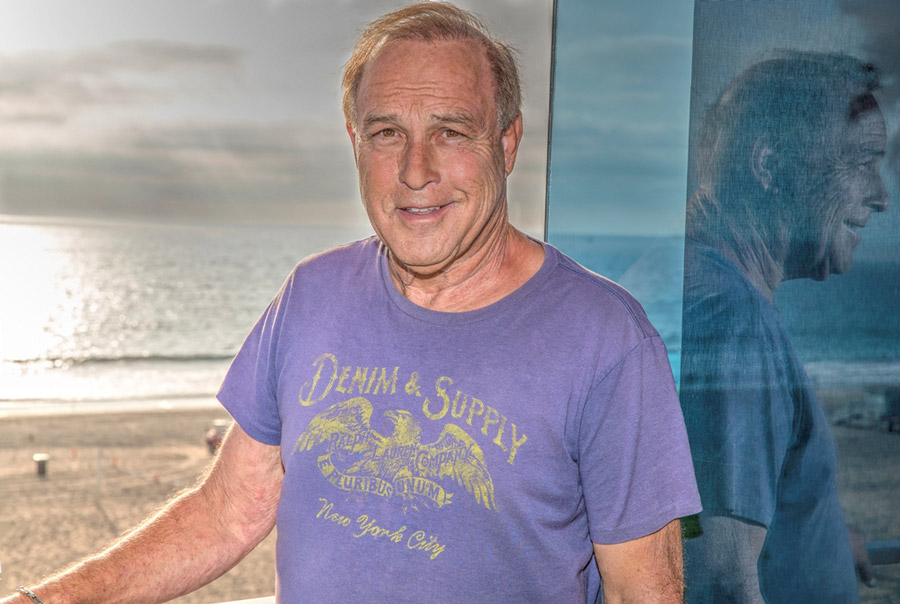

Matt Morris of Christie’s Strand Hill Properties and Matt Morris Development has had an impact on local custom-building for over 20 years. What started as a desire to do “something totally different in development” has led to a spirit of “taking risks” and creating some of the area’s more innovative homes.

Morris grew up in Dallas, Texas and knew “since junior high school” that he wanted to be a builder. His father was a commercial developer and his brother would become one as well. He went to University of Arizona to play football and after graduation moved back to Dallas to build homes for close to 18 months. In this time he went from doing mundane errands to becoming the top builder for the company.

His brother needed help after relocating to the South Bay and so Morris moved to the beach cities to work with him for what he planned to be a brief time. He recalls being 24 years old and living by the Galleria. Those early years here were tough to the point that “he was barely scraping by.”

He felt compelled to do make a shift and teamed up with some investors to do custom build-outs. They had some early successes. He rolled his profits into the next deal and the pattern continued until he made it. Along the way, he got a real estate license to make it easier to find potential lots to develop. He attributes a lot of his success to being “lucky in terms of timing.”

Over the years, Morris refined his “eye for looking for detail” as part of his process to capture his “client’s taste and personality in the design.” Long-lasting bonds have been formed as a result of this.

Morris collaborates with architects and designers to produce the best fit for a given property. He recognizes that every lot offers unique design opportunities. Each design begins with “letting the property dictate what to do” and a “lot of things are worked out in the field.” A recent example is a development on the corner of 1st Street and Manhattan Avenue in Manhattan. He took a risk with “a different look with a lot of glass to maximize the views,” among other unique design features.

Our community “wants more personality and sophistication in their homes and not cookie-cutter designs,” he said.

As seen in Easy Reader

Photo: Matt Morris, Matt Morris Development. Photo by Brad Jacobson (CivicCouch.com)